|

|

|

|

A recent article written by Joseph Gray published by DirectConnect.

Explosive Growth in 45-Second TV Commercial Format Led by Pharma Advertisers

A new study shows surprising growth in longer television ad formats. Conducted by Southern California-based research firm, DRMetrix, the study finds 2018 year-over-year growth in the number of 45 second spots grew by 583.86%, 75 second spots grew by 184.62%, and 180 second spots grew by 487.03%. This is some of the interesting data that has surfaced in DRMetrix’s new AdSphere 5 x 5 industry study that is being released next week to attendees of the PDMI-West event. The study trends data across 5 years (2015 – 2019) and across 5 different segments of direct-response-television and brand-direct advertising.

For its analysis, DRMetrix’s AdSphere system was used to monitor 130 national networks using state-of-the-art automated content recognition (ACR) and included in its study any ad that provided a phone number, web address, mobile SMS code or app store logo from Apple or Google. “What’s unique about this group of advertisers is that they have the ability to immediately measure consumer response to their commercials allowing them to quantify differences in overall response to different ad formats.” said Joseph Gray, CEO of DRMetrix. “These types of advertisers have discovered what direct-response-television advertisers have known for decades – that longer ad formats are more effective.”

In explaining his latter point, Gray invoked David Ogilvy, the man whom many consider the father of modern advertising. In a famous speech called “We sell or else” from the 1960s, Ogilvy lauded the value of direct-response advertising and predicted the worlds of direct response and general advertising were on a collision course.

“Ogilvy recognized that longer ad formats on television were more effective than shorter formats and that direct response advertisers were unique in their ability to determine which aspects of their television buys were actually working,” Gray said. “He famously remarked, ‘You know to a dollar’ what you are spending.”

Ogilvy also predicted the practitioners of general advertising would one day learn from the experience of the direct-response industry and stated it would be within the power of direct-response practitioners to rescue the advertising business from its “manifold lunacies.”

Hot off the press. In 2018, network cable generated $28 billion in TV advertising revenue. Of this amount, 12.3 billion, roughly 44%, was from ads that featured a way for consumers to respond including web, mobile, or phone! For more more details, please click here: http://tiny.cc/0ssvdz

The new AdSphere October build marks a significant milestone but first, a big “thank you” to all of our users! We could not have achieved this accomplishment without your support, feedback, and suggestions.

Since the creation of AdSphere, one of the biggest challenges has been how to provide insights into direct response spend in a responsible way. We’ve heard from many that disclosure of remnant DR rates would hurt the industry. We listened and have searched for a solution. Initially, DRMetrix created its Spend Index methodology as a way for users to understand spend level differences between brands and advertisers without divulging remnant DR rates. However, the Spend Index came with many shortcomings. Over the past couple of years, we have been working on a more transparent and transformative solution.

Adsphere is the first television research system to segment the direct response industry into different classifications such as short form products, lead generation, and long form (28.5m). These classifications are comprised of campaigns using DR variations to track response and ROI back to specific network/daypart/creatives. When we say, “Know where ROI is found – Know AdSphere” we are referring to AdSphere’s unique ability to extract meaningful and actionable insights from these types of campaigns. In contrast, Brand/DR campaigns use a vanity call to action and do not have the ability to track consumer responses or ROI back to specific network/daypart/creatives. They have different objectives often translating their buys into traditional brand metrics. Brand/DR advertisers pay higher rates for clearance given reach and frequency goals. DRMetrix has been working to build the industry’s first rate database based on Brand/DR rates which will replace the Spend Index. We have achieved this by receiving input from numerous agencies and advertisers, as well as collaborating with Standard Media Index (SMI), who works with many of the largest media holding companies in the industry.

In developing this new approach, our goal has been to provide directionally accurate insights that represent what the top of the marketplace is paying for network rotation-of-schedule (ROS) daypart inventory. To clarify, DRMetrix is not using program specific brand rates nor are we using remnant DR rates. Today, the majority of national ROS daypart inventory is being sold to Brand/DR advertisers. Accordingly, using these rate metrics will provide the industry with a more realistic understanding of the size of the direct-to-consumer marketplace. DRMetrix has also collaborated with leading infomercial agencies and advertisers to build a rate database for 28.5 minute infomercials. To avoid industry disruption, we’ve added a premium to our infomercial rates. By design, spend projections in the new build of AdSphere will be higher than traditional remnant DR spend.

As a new rate database, we expect that some anomalies will exist in the data where certain network ROS dayparts may be over or under weighted. We ask our community for feedback so that we may improve the data over time. To help expose anomalies, we are providing our users with an quick and easy way to provide feedback. From the network dropdown menu on the AdSphere home page, or from any of the airing detail network pages, please look for the new “rate review” icon. When you click on this icon, it will pop up a Network Rate Review form where you may provide feedback!

Disclaimer: DRMetrix will make network / daypart rate adjustments as deemed appropriate based on community feedback and upon consultation with agency rate contributors and data partners. As always, feedback from our community of users is greatly appreciated!

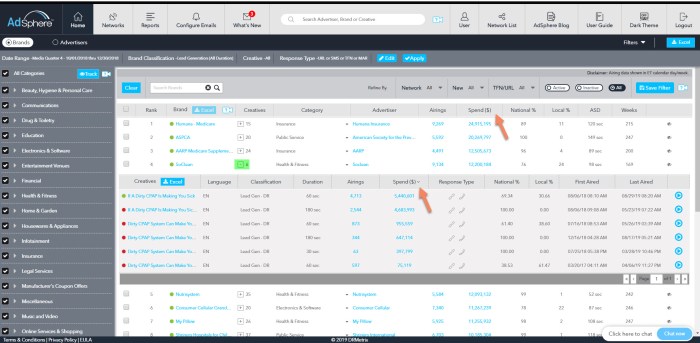

Aside from the Spend Index being replace to the favor of new directional Brand/DR rate averages, here are some of the other exciting feature enhancements you will find in this latest build of AdSphere.

DRMetrix now monitors over 130 networks including ABC, CBS, NBC, and FOX! If your favorite network isn’t monitored by DRMetrix, please request that they contact us! Being part of the AdSphere industry platform helps networks attract more business and grow advertising revenue!

Now you have the freedom to track projected spend dollars by Advertiser, Brand, or Creative. Get a better sense of spend levels across 170+ industry categories. Trend 28.5 minute infomercial billings or any other creative length over time! Trend spend by industry classification, creative language, response types, and more. A treasure trove of industry data is now at your fingertips!

Directionally accurate spend metrics make a world of difference. Analyze spend by network, program, daypart, breaktype, and more! As a feature update, you can now change the date range without having to leave the airing detail page. The page is also fully dynamic meaning that any filters applied will update the entire page which includes the network list on the bottom. You can change the underlying data using any combination of networks, day of week, hour of day, standardized dayparts, and now even programs! After you apply your filters and click apply, the entire page will update with the networks at the bottom sorted by either spend or airings. With the addition of the program column, you can pop open a report showing the spend by program for any network on the fly with a convenient excel output.

As an example, let’s say you want to see the networks sorted by spend for weekend airings. You can choose SAT/SUN from the “All Days of Week” dropdown and click Apply. Now, only the SAT/SUN airings will be considered and the list of networks will be sorted by weekend spend. Click the excel button on the bottom left to export all of the summary data based on your filter settings.

Advertisers who use DR Variations in their commercials vote every day on the networks, dayparts, and programs that work best. They vote with their wallet focusing on where ROI is found while discontinuing media that underperforms. Now it is possible to analyze entire industry categories to determine which networks, dayparts, and programs are commanding the highest share of category dollars.

From the home page, click to open the new network filter. As an example, let’s run a year-to-date report for the category Beauty, Hygiene & Personal Care. (Alternatively, you can select any group of over 170+ categories in AdSphere). Let’s also filter for the brand classifications short form products and lead generation in order to limit the results to just those creatives using DR Variations.

Now that we have our desired ranking report, we can determine the top networks, dayparts, and programs for the entire category. In our example, there are over 80 brands and 179K airings for the Beauty, Hygiene & Personal Care category. Open the network selector and click the new excel report as shown below. You will receive a four tab report ranking network by spend, daypart by spend (M-F), daypart by spend (S-S), and program by spend. Just like that, you have taken a survey of 80+ brands and discovered the best performing networks, dayparts, and programs!

Now, you can change the date range on Advertiser Pages and see projected spend for all brands and creatives. When you click on an advertiser, brand, or creative hyperlink in the ranking system, the advertiser page will default to the same date range as the ranking report. These pages will no longer default to lifetime view. The only exception will be from Global Search where advertiser pages will continue to default to lifetime date range.

This new feature is designed to work with saved filter reports that use any of the six timeframes highlighted in the image. When saving a filter with any of these settings, you may click the email button to have the report automatically run and emailed to you on the following schedule:

Current Week – Reports will be emailed at the end of each day

Current Month – Reports will be emailed either daily or weekly depending on your choice.

Current Quarter – Reports will be emailed daily, weekly, or monthly depending on your choice.

Last Week – Reports will be emailed at the end of each week.

Last Month – Reports will be emailed at the end of each month.

Last Quarter – Reports will be emailed at the end of each quarter.

A schedule email column has been added to the Filters dropdown as you can see in this picture. Any filter that was created with one of the six choices above can have the email feature toggled on. In the example shown, the schedule email box was clicked and a dialog box appears allowing the user to choice to receive the saved filter report daily or weekly.

Your email tracking & alerts now appear alongside your scheduled filter report emails in one convenient place. The new configure emails tab replaces the prior configure alerts tab. It acts as a central hub for all of your Adsphere email communications. You can filter the page for any combination of Category, Advertiser, Brand, or Network alerts as well as any saved filter email reports that you have scheduled.

My family had a very heart warming experience this summer. I wanted to share the story because I believe it demonstrates the importance of family as well as the basic goodness of people.

Our story begins with my great grandparents who immigrated to America from Italy in 1920. After a couple of generations, contact was lost with the Italian relatives. After the death of my grandparents, I began to feel the significance of not having this connection. I also worried that my two sons may never experience, or build an appreciation of, their Italian heritage.

With our oldest son going off to college at the end of the summer, we wanted to do something special and decided to take our boys to Italy. In addition to visiting famous cities like Rome and Florence, we planned to venture south to the Puglia region where our ancestors are from. They lived in a town that no longer exists called Canneto di Bari. I had imagined how amazing it would be to visit this area and to meet some of them. While I had previously dabbled with online genealogy services, such as Ancestry.com, I was now focused like never before to try and locate our lost cousins. Using Ancestry.com, I was able to expand the branches of our family tree finding Italian ancestors as far back as 1781. In addition to Ancestry.com, I tried using DNA family matching services from two other online services. Despite all of the progress, and many hours of work, I was still struggling to locate Italian relatives that shared the surnames of my grandparents. While millions of Americans have participated in new DNA family matching services, fewer Italians have. I was finding lots of cousins in America but none in Italy!

My mother and uncle both tried to assist me in my genealogy research. While they weren’t certain of any living Italian relatives, my uncle explained that he was connected to someone in Italy on Facebook with a matching surname. So I began to leverage social media to try and locate family members. I connected to my Uncle’s contact and then in turn with a number of his connected family members. I invited them all to a closed group I created on Facebook called, “Our Italian Family” where I introduced myself and explained what I was trying to accomplish. Thanks to Google translate, I was able to post messages in both English and Italian. I received mixed reactions from the Italian side. A few assumed we were related while others cast doubt. I was unable to find anyone on the Italian side that had an extensive family history which has made it impossible to find ancestors in common. After a period of time, I connected with a family member who was able to communicate in English. We’ll call her Cathy, to protect her privacy. Cathy was very sweet and helpful. Before long Cathy and I were working together to try and find a common family ancestor. My first thought was to see if any of the elder family members would be willing to provide their DNA. It would appear that these DNA family match services can help determine relationship up to 4th or 5th cousin.

Cathy approached her father, we’ll call him Gerald, who was willing to assist in our efforts so I had a DNA test kit mailed to him. Prior to our visit, Cathy informed me that she had a surprise in the works. Many years ago, Canneto di Bari had merged with a neighboring town to form modern day Adelfia. The city maintains some municipal records that can be used for genealogy research but a lot of information is missing or difficult to come by. A variety of other factors, including World War 1 and 2, had further compromised municipal records in Italy. The surprise was that Gerald had planned a trip to Adelfia (two hour round trip for him) to locate historical records to try and find an ancestor in common ahead of our visit! Unfortunately, he was not able to acquire a great deal of information on his visit but the city said they would keep looking for the records and would contact him in the future should they find anything. We knew there would not be time to get the DNA results back ahead of our trip to Italy. Regardless, we made plans to visit with Cathy, Gerald, and their family while in Puglia.

Cathy had suggested we stay in Monopoli which is a beautiful seaside resort town. It is located about an hour south of where her family lives. We took the train from Florence to Bari and rented a car to drive to Monopoli. We had booked an extra room at our hotel and invited them as our guests. We arrived in the late afternoon and visited with Cathy, her husband, and their two small children. On our arrival, Cathy’s husband spoiled us with appetizers he had prepared including Italian meats, cheeses, bread, and even sparking wine! Cathy’s young daughter presented us with a drawing welcoming us to Puglia. Later that evening, we went out to dinner and, before I realized what had happened, her husband had picked up the tab. They made us feel welcome and very special.

The next day, Cathy’s father Gerald had arranged a special lunch at a local restaurant. The whole extended family attended! Gerald, his wife, and all of their children and grandchildren – in total around 17 family members. I sat next to Gerald and used Google translate to engage in conversation. It wasn’t perfect but it worked well enough!

I haven’t experienced a meal like this since the holidays when my Italian Grandparents were still alive. Food is a form of art in Italy and course after course of amazing artistry kept coming out of the kitchen until our eyes were popping out of our heads! Mussels, Oysters, Octopus, Swordfish, Shrimp, Pasta, Zucchini, Fritters, Bruschetta, Fruit, Gelato, and so much more! Cathy had told me in advance that this meal was Gerald’s treat but I had not anticipated anything approaching the lavishness of this meal let alone the warmth and hospitality of this family. I found myself overwhelmed as I tried to wrap my head around what was happening. Forget family trees and DNA test results, this family had decided to embrace my family regardless.

After spending the afternoon together, and sharing the most wonderful meal, we had a lovely picture taken of our new Italian family. While Rome and Florence were nice, we found the true heart of Italy in Puglia. It was represented by this loving family who so touched our hearts.

A new trend has emerged where cable networks are collaborating with MVPD and vMVPD partners to turn their national ad inventory into something far more appealing to brand advertisers. Armed with new capabilities, cable networks are already starting to offer brand advertisers the ability to target their television commercial to their ideal audience. This creates an opportunity for direct response advertisers to have their commercials delivered, during the same ad breaks, to all the leftover households.

Before we get into how these new “advanced advertising” break types work, let’s look at how national cable break types have worked historically.

On the left side of the diagram below, a cable network sends its signal via satellite to two different MVPDs. If you aren’t familiar with the term, and haven’t clicked one of the links above, MVPD is short for Multiple Video Program Distributor. MVPD is a catch-all phrase to describe all of the television distribution companies that sell access to network cable programming via cable, satellite, fiber, or via internet (the latter referred to as an vMVPD where “v” is short for “virtual”). In the past, we’ve only had to understand and deal with two break types. We had the national ad break, in which commercials were seen by viewers nationwide, and we had the DPI ad break. Most cable networks cut to a DPI ad break 2 minutes out of every hour. As shown below, a cable network has sold a commercial to Expedia to run during a DPI ad break. Buying this type of ad break is how direct response advertisers have purchased leftovers at a discount for many years.

To help explain, DPI ad breaks are preceded by a Digital Program Insertion (DPI) signal. Most MVPDs have ad-insertion equipment that listens for the DPI signal. As soon as the DPI signal is detected, the ad insertion equipment begins inserting commercials sold by the MVPD to local advertisers. In the diagram below, one of the two MVPDs is shown inserting a Flex Tape commercial covering up the Expedia commercial. In most markets, including urban markets, the MVPDs aggressively sell local advertising covering up most, if not all, of the ads like Expedia running on the network at the same time. However, in smaller rural markets, the MVPD may not sell local advertising as demonstrated by the second MVPD below which doesn’t insert an ad allowing the Expedia ad to be seen by viewers in their market. These are the leftovers that direct response advertisers expect to receive when buying DPI break inventory from the cable networks today.

With new advanced television advertising models, the networks use a different type of DPI signal to let certain MVPDs, who have a contract with the network, know that it’s time for them to deliver the advanced advertising commercial to its intended audience. At the same time, the network may run a direct response commercial on its network feed to be viewed by any households not otherwise targeted by the advanced advertising campaign. One of the network groups stated that a smaller universe of MVPDs are currently involved in their advanced advertising programs. To other MVPDs, this new type of ad break looks just like any other national ad break which they are not allowed to cover up. Accordingly, the audience composition for this new type of ad break is likely quite different in comparison to the traditional DPI ad break.

DRMetrix is the first television research company to monitor national cable DPI signals in order to recognize and segment between the two traditional ad break types. Our company is currently collaborating with cable networks in an attempt to detect the alternative DPI signals that are starting to be used in the marketplace to signal these new advanced advertising breaks. For now, DRMetrix flags all commercials running outside of normal DPI breaks as “national”.

Some networks have taken to inserting direct response ads in DPI breaks and their new advanced advertising breaks billing both as a regular DPI ad break. Some agencies have started to notice the discrepancy as DRMetrix continues to report the advanced advertising breaks as “national”. DRMetrix has had to explain to various agencies what is happening and quite often the agencies are unaware of the new break type. So, we thought this article would help to set the record straight!

Please provide us with your feedback and questions on our blog! We’d love to hear from you.

Progressive, Nutrisystem, E. Mishan & Sons, Guthy-Renker, Luminess Direct, Proactiv+, and the late George Smith among those being honored

DRMetrix, the leading research company for the DRTV industry announces its 3rd annual AdSphere™ Awards honoring the most effective direct response television advertisements airing on national television outlets in 2018.

DRMetrix created the AdSphere Awards to honor the top advertisers and brands in the industry. The awards will be presented to recipients attending PDMI EAST 2019, where leaders in Performance-Driven Marketing will come together in Miami, Florida from March 31st – April 2nd, 2019. AdSphere Awards is the first awards program to be inclusive of the entire DRTV industry with advertisers such as Allergan, AT&T Services, AbbVie, Vista Print, Zillow, TripAdvisor, Lens Crafters, and many others being honored.

“The AdSphere awards recognize best-of-class advertisers across four industry classifications including short-form products, lead generation, brand/direct, and 28.5-minute infomercials,” said Joseph Gray, AdSphere Awards founder and CEO of DRMetrix. “Performance-based campaigns achieving this level of scale demonstrate consumer popularity and also best-in-class creative and media execution. The AdSphere Awards are the most inclusive ever for the DRTV industry recognizing nearly 70 honorees including all of our best-of-category award recipients.”

AdSphere monitors a universe of 125+ national networks on a 24/7/365 basis. In just over four years, AdSphere has identified over 10,000 brand-direct and direct response brands. In addition to detecting over 384,000 infomercial (28.5 minute) airings, AdSphere has detected over 40 million spots of varying creative lengths up to five minutes in duration. The awards recognize top brands across a wide range of industry categories representing all facets of the DRTV industry. AdSphere segments DRTV campaigns across 20 major categories and 145 sub-categories. The complete list of “Best of Category” AdSphere Award winners for 2018 is online at www.drmetrix.com/adsphere-awards.html.

In addition to the “Best of Category” awards, the following top six advertisers of 2018 will receive the coveted AdSphere Award:

Advertiser & Brand of the Year

Classification -Brand/Direct

Progressive

Advertiser & Brand of the Year

Classification – Lead Generation

Nutrisystem

Advertiser of the Year

Classification – Short-Form Products

E. Mishan & Sons

Advertiser & Brand of the Year

Classification – Long-Form

Guthy | Renker – Meaningful Beauty

Brand of the Year

Classification – Short-Form Retail Products

Luminess Silk Infinite Beauty Collection

Brand of the Year

Classification – Short-Form Products

Proactiv+

Industry Veteran, George Smith, who passed away on 2/14/19 will also be honored with an AdSphere Award for his lifetime of achievements on behalf of the direct response television industry.

No political statements being made here. That said, this month we’ll be combining airings for both English and Hispanic networks in our default AdSphere rankings and on our weekly Retail Reporting to make sure advertisers are getting ranking credit for both English & Hispanic buys in one integrated view. You’ll still be able to change the default filters and choose English only rankings (classic view), Spanish or “both” which will be the new default. DRMetrix looks forward to monitoring more Hispanic networks in 2019.