The biggest build, since the original launch of AdSphere

The new AdSphere October build marks a significant milestone but first, a big “thank you” to all of our users! We could not have achieved this accomplishment without your support, feedback, and suggestions.

Since the creation of AdSphere, one of the biggest challenges has been how to provide insights into direct response spend in a responsible way. We’ve heard from many that disclosure of remnant DR rates would hurt the industry. We listened and have searched for a solution. Initially, DRMetrix created its Spend Index methodology as a way for users to understand spend level differences between brands and advertisers without divulging remnant DR rates. However, the Spend Index came with many shortcomings. Over the past couple of years, we have been working on a more transparent and transformative solution.

Adsphere is the first television research system to segment the direct response industry into different classifications such as short form products, lead generation, and long form (28.5m). These classifications are comprised of campaigns using DR variations to track response and ROI back to specific network/daypart/creatives. When we say, “Know where ROI is found – Know AdSphere” we are referring to AdSphere’s unique ability to extract meaningful and actionable insights from these types of campaigns. In contrast, Brand/DR campaigns use a vanity call to action and do not have the ability to track consumer responses or ROI back to specific network/daypart/creatives. They have different objectives often translating their buys into traditional brand metrics. Brand/DR advertisers pay higher rates for clearance given reach and frequency goals. DRMetrix has been working to build the industry’s first rate database based on Brand/DR rates which will replace the Spend Index. We have achieved this by receiving input from numerous agencies and advertisers, as well as collaborating with Standard Media Index (SMI), who works with many of the largest media holding companies in the industry.

In developing this new approach, our goal has been to provide directionally accurate insights that represent what the top of the marketplace is paying for network rotation-of-schedule (ROS) daypart inventory. To clarify, DRMetrix is not using program specific brand rates nor are we using remnant DR rates. Today, the majority of national ROS daypart inventory is being sold to Brand/DR advertisers. Accordingly, using these rate metrics will provide the industry with a more realistic understanding of the size of the direct-to-consumer marketplace. DRMetrix has also collaborated with leading infomercial agencies and advertisers to build a rate database for 28.5 minute infomercials. To avoid industry disruption, we’ve added a premium to our infomercial rates. By design, spend projections in the new build of AdSphere will be higher than traditional remnant DR spend.

As a new rate database, we expect that some anomalies will exist in the data where certain network ROS dayparts may be over or under weighted. We ask our community for feedback so that we may improve the data over time. To help expose anomalies, we are providing our users with an quick and easy way to provide feedback. From the network dropdown menu on the AdSphere home page, or from any of the airing detail network pages, please look for the new “rate review” icon. When you click on this icon, it will pop up a Network Rate Review form where you may provide feedback!

Disclaimer: DRMetrix will make network / daypart rate adjustments as deemed appropriate based on community feedback and upon consultation with agency rate contributors and data partners. As always, feedback from our community of users is greatly appreciated!

Aside from the Spend Index being replace to the favor of new directional Brand/DR rate averages, here are some of the other exciting feature enhancements you will find in this latest build of AdSphere.

Welcome to ABC, CBS, NBC, and FOX!

DRMetrix now monitors over 130 networks including ABC, CBS, NBC, and FOX! If your favorite network isn’t monitored by DRMetrix, please request that they contact us! Being part of the AdSphere industry platform helps networks attract more business and grow advertising revenue!

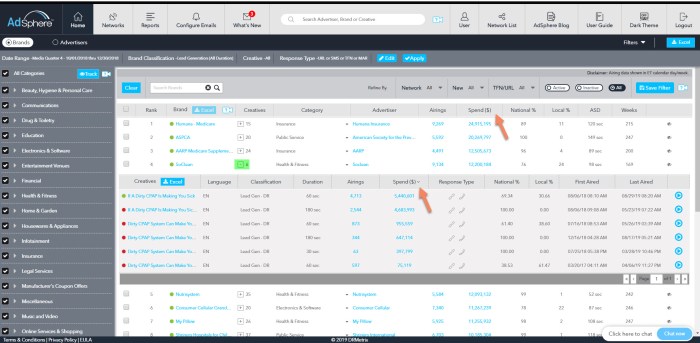

Rankings with Projected Spend Dollars for Advertiser, Brand, and Creatives

Now you have the freedom to track projected spend dollars by Advertiser, Brand, or Creative. Get a better sense of spend levels across 170+ industry categories. Trend 28.5 minute infomercial billings or any other creative length over time! Trend spend by industry classification, creative language, response types, and more. A treasure trove of industry data is now at your fingertips!

New Dynamic Airing Detail Page with Spend Metrics!

Directionally accurate spend metrics make a world of difference. Analyze spend by network, program, daypart, breaktype, and more! As a feature update, you can now change the date range without having to leave the airing detail page. The page is also fully dynamic meaning that any filters applied will update the entire page which includes the network list on the bottom. You can change the underlying data using any combination of networks, day of week, hour of day, standardized dayparts, and now even programs! After you apply your filters and click apply, the entire page will update with the networks at the bottom sorted by either spend or airings. With the addition of the program column, you can pop open a report showing the spend by program for any network on the fly with a convenient excel output.

As an example, let’s say you want to see the networks sorted by spend for weekend airings. You can choose SAT/SUN from the “All Days of Week” dropdown and click Apply. Now, only the SAT/SUN airings will be considered and the list of networks will be sorted by weekend spend. Click the excel button on the bottom left to export all of the summary data based on your filter settings.

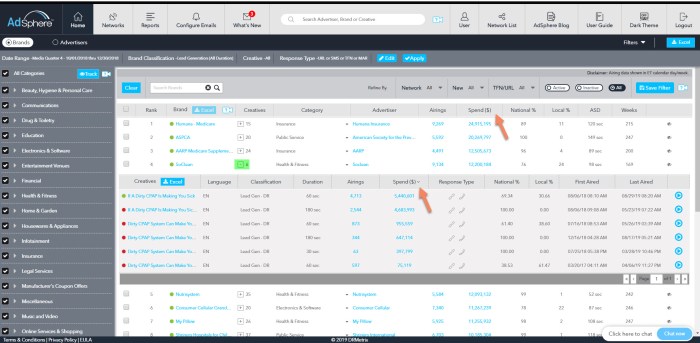

Rank Networks, Dayparts, and Programs by Industry Category!

Advertisers who use DR Variations in their commercials vote every day on the networks, dayparts, and programs that work best. They vote with their wallet focusing on where ROI is found while discontinuing media that underperforms. Now it is possible to analyze entire industry categories to determine which networks, dayparts, and programs are commanding the highest share of category dollars.

From the home page, click to open the new network filter. As an example, let’s run a year-to-date report for the category Beauty, Hygiene & Personal Care. (Alternatively, you can select any group of over 170+ categories in AdSphere). Let’s also filter for the brand classifications short form products and lead generation in order to limit the results to just those creatives using DR Variations.

Now that we have our desired ranking report, we can determine the top networks, dayparts, and programs for the entire category. In our example, there are over 80 brands and 179K airings for the Beauty, Hygiene & Personal Care category. Open the network selector and click the new excel report as shown below. You will receive a four tab report ranking network by spend, daypart by spend (M-F), daypart by spend (S-S), and program by spend. Just like that, you have taken a survey of 80+ brands and discovered the best performing networks, dayparts, and programs!